Yes, I want to buy in Zalando.com! Free delivery, free returns, 30-day returns guarantee and a free helpline. It´s the first time that I´ve visited an e-commerce which is selling in Spain with all this so confident and attractive claims calling to buy. It´s like the “delivering happiness” from Zappos.com but in Europe (actually selling in fourteen European countries). Fantastic!

Figure 1. Zalando is available in fourteen countries (24/04/2013)

It is something to what we are not accustomed. I think this marketing strategy is which the Spanish market was needing for to stimulate the e-commerce sales in a similar ratio to other European countries. Zalando is a clear, confident and direct “buy here my friend” online retailing without conditions and brakes to the purchase.

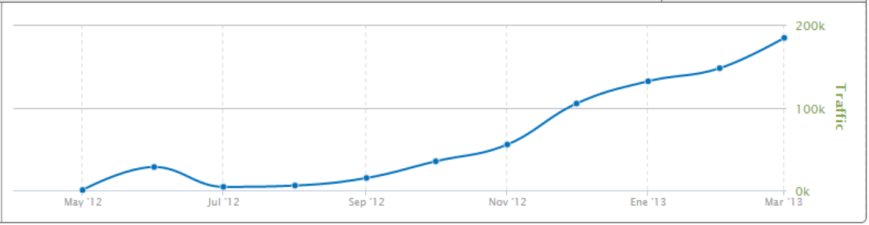

Figure 2. Zalando.es internet traffic evolution in Spain. Source: Semrush

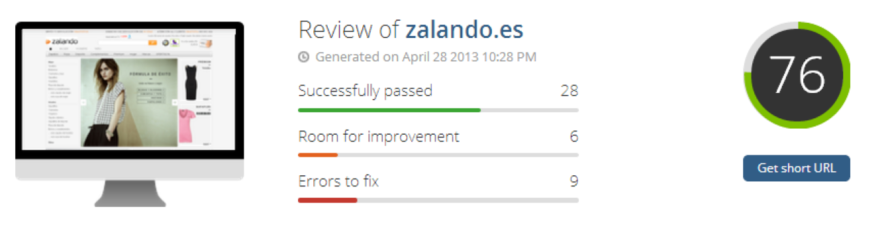

The Spanish E-commerce and Digital Marketing Managers/Directors must pay attention to this e-commerce brand. In my opinion, they have many things good on which we should notice. In the last five months they have grown 100 % in web traffic (Figure 2). In one year, they obtained a global Internet Marketing Effectiveness KPI of 76 over 100 in Woorank. For example, this is closely together of the KPI of the giant Zara.com and Elcorteingles.es nowadays with 77 and 80 respectively, over Adolfodominguez.com with 71. And it is possible that in one more year it reaches Zappos.com with 87 if they improve the fifteen rooms for improvement and errors to fix according to Woorank.

Figure 3. Zalando.com global KPI index. Source: Woorank

Related articles

- RPT-Germany’s Zalando eyes profitability in core markets (uk.reuters.com)

- The Future of Online Retail is Curation says Zappos Labs (contentcurationmarketing.com)

- Adolfo Dominguez: on the right path to success (ecommerceeyes.wordpress.com)