Apparel sales will lead the e-commerce growth through 2016. This is possible thanks to the principal brands, which are investing in robust e-commerce solutions, and to shoppers who are more confidence in buy online. But, what about the children´s clothing brands? Are they following this trend?

Well, one of the sub-categories of the apparel which is waking up is children´s clothing brands. However, there are still many of the most popular children´s clothing brands which are now selling online. I have searched the principal brands and I formed this list:

Catimini, Chipie, Clayeux, Deux par deux, Devi, Diesel Kids, Greggy Girl, Indygo Artwear, Jottum, Juicy Couture, Kids – TRUNK LTD, L’orange, Lipstik, Little Mass, Luna Luna ,Copenhagen & HubcapKidz, Mayoral, Meli Meli, MIM-PI, Mimi & Maggie, My Vintage Baby, Oilily, Tea Collection, True Religion and Wes and Willy.

I have willfully avoid the biggest, gigant brands like Zara.com, HM.com, Gap.com, etc. (Figure 1) because, in my opinion, all they have a notorious history of online sales in the last 3 years. My intention is to analize the situation of the popular middle-size brands in the market to determine if they are mature on Internet sales.

Figure 1. Main Apparel Brands – global Internet visits.

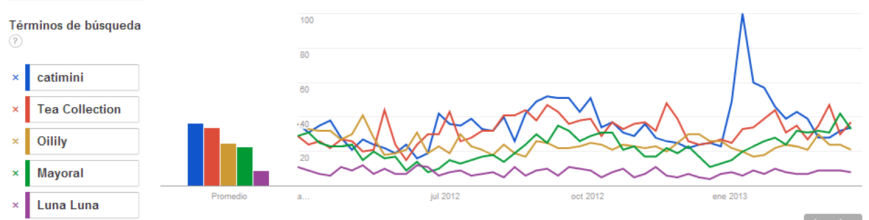

And I have selected five more popular considering no geografic location filters, in all the range of time available, and cathegory Shopping/Apparel/Children´s Clothing using the tool Google Trends.

Finally I found that these are the five most popular (Figure 2): Catimini (France), Tea Collection (USA), Oilily (The Negerlands), Mayoral (Spain) and Luna Luna (USA) .

All of them have a correct web page, but two of them don´t have an online shop yet (April 2013): Mayoral.com and Catimini.com.

Then, considering that the sample is good, this means that at least the 25% of the middle-sized and smaller children´s fashion brands are not still selling online.

This 25% of brands in our sample which have no online shops, should be influenced by the culture of their countries. Both are European. There, in those countries, the e-commerce had been growing more slowly than in USA until 2012.

In France and Spain, the proportion of Internet users who shop online was of 63% and 29% respectively (Figure 3). This data is especially low in Spain. And so, we can understand that, due to this influence, an international apparel brand like Zara.com didn´t have its online shop until September 2010.